Financials

Financial Overview and Statements

In order to deliver the most impactful and life-changing camper experiences, Roundup River Ranch is committed to transparency, fiscal responsibility, and best practices in governance.

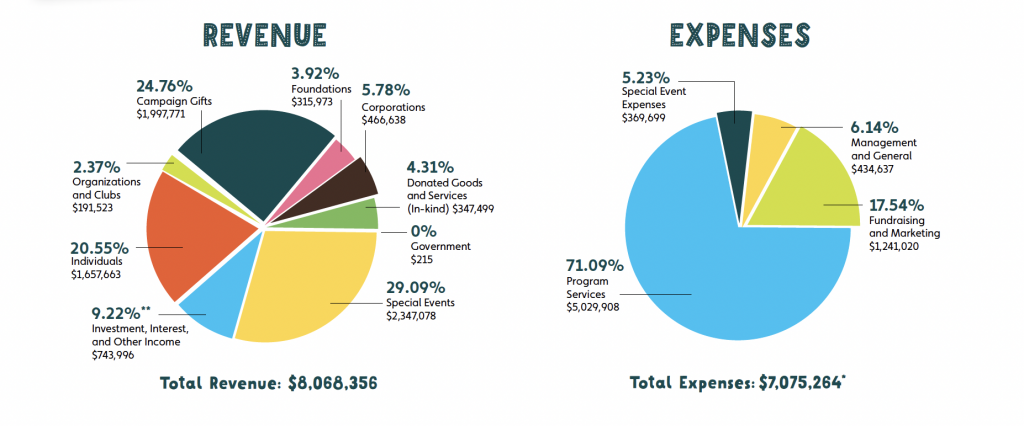

Financial information from November 1, 2023, through October 31, 2024, is based on FY2024 audit.

* Annual fixed asset depreciation ($742,430) is included in the expense chart. When comparing cash expenses with revenues, excluding annual asset depreciation, Roundup River Ranch maintains a balanced cash budget. In-kind expenses are allocated within their corresponding department in each of the expense categories.

** Total long-term investment gains totaled $1,521,034. Realized gains listed above total $309,756 which were transferred from Endowment accounts to support annual operations.

Roundup River Ranch’s auditors certified that the FY2024 financials comply with the Philanthropy Advisory Service of the Council of Better Business Bureau’s and American Institute of Philanthropy’s standards and that our expense allocations are consistent with best practices in nonprofit management and fundraising. In addition to reviewing financials, organizational transparency, governance, leadership, and program results are important indicators of excellence in nonprofit performance.

_________________________________________________________________________________________________

VIEW OUR 2024 IMPACT REPORT. >

_________________________________________________________________________________________________

Financial Statements

2024 |

2020 |

2023 |

2019 |

2022 |

2018 |

2021 |

2017 |